The Property Pulp deal analyzer tool is a comprehensive yet adaptable tool designed to suit both beginner and seasoned investors. It incorporates industry-standard metrics, providing you with a detailed analysis of potential investments. This guide aims to explain each field within the input and output sections and offer tips on how to effectively utilize them. The mathematical foundations of each formula are also available within the tool and at the end of this guide.

______________

Getting Started:

It’s not necessary to fill out every field to generate your report. For those seeking a rapid cap rate estimate, merely inputting the purchase price, projected rent, and some expenses will suffice. The tool’s flexibility is designed to accommodate speedy calculations using minimal data. Nevertheless, if a comprehensive understanding and precise tracking of every dollar are what you desire for your investment, rest assured that this tool fully supports that level of detail as well.

Input Section:

Acquisition:

Purchase Price: The amount needed to secure the property.

Holding Period: The intended duration of holding the property. If you plan on holding the property indefinitely, consider inputting the loan duration (e.g., 360 months for a 30-year loan).

Months to Renovate: The expected renovation duration.

Closing Costs: Anticipated closing expenses, which can vary significantly by location. As a rule of thumb, estimate between 2% and 5% of the property price. This percentage accounts for the cost of obtaining the purchase loan.

Itemized Closing Costs: Allows for detailed itemization of each closing cost instead of a flat amount.

Financing:

Down Payment: The anticipated percentage of the purchase price to be paid upfront. Typically, this is around 20% for most conventional loans.

Loan Term: The loan’s duration. Common loan lengths are 30, 20, and 15 years, with a 30-year term being the most prevalent.

Loan Interest Rate: The loan’s interest rate. As of 2023, rates are around 7%.

Loan Costs: These are typically between 1% and 2% of the loan amount, accounting for broker fees, discount points, etc.

Interest-Only Mortgage: Select this option if you have an interest-only mortgage, often utilized by investors.

Refinancing:

If you intend to refinance your property (common due to the current interest rates), enter the details in this section:

Refinance Property Value: The anticipated property value at the time of refinancing.

Refinance Down Payment: The expected percentage of the refinance property value to be paid upfront.

Refinance Term: The length of the refinanced loan.

Refinance Interest Rate: The interest rate of the refinanced loan.

Refinance Year: The year which you plan to execute the refinance. The refinance will occur at the end of the chosen year.

Refinance Loan Costs: These account for broker fees, discount points, etc. and are typically between 1% and 2% of the loan amount.

Interest-Only Refinance: Select this if you have an interest-only refinance mortgage.

Operation:

These inputs relate to the property’s operations and potential rental income:

Rent: The expected monthly rent income from tenants.

Vacancy Percentage: The expected property vacancy rate. Typically, investors budget between 3% and 10%.

Property Tax: The anticipated monthly state and local tax.

Insurance: The monthly insurance cost. This depends on the property’s location and the type of insurance required (homeowners, flood, etc.).

HOA Fees: Monthly fees for properties within a Homeowners Association (HOA).

Annual Leasing Fee: A fee charged by some property managers for tenant screening and placement. As tenant turnover time is unpredictable, this fee is accounted for annually.

Property Management: The cost of hiring a property management company, usually between 6% and 10% of the monthly rent.

Other Operating Expenses: Other operating costs not included above.

Capital Expenditures:

The Capital Expenditures section gives you two options for calculating your CapEx expenses. As a flat percentage of your property’s value or, on an item-by-item basis.

Some investors prefer to use a standard percentage – usually between 1% to 2% of the property’s value – as a way to budget for CapEx. This method is quick and simple, offering a straightforward way to set aside funds for major repairs and replacements.

However, for a more accurate estimate, you may want to calculate each CapEx item individually. This involves breaking down every major component of the property that will eventually need replacement, determining its lifespan, and estimating the replacement cost.

To illustrate, let’s take the example of a roof:

Item name: Roof

Replacement Cost: $20,000

Life: 20 years

Life Remaining: 10 years

Using this information, the tool will calculate your yearly CapEx budget for the roof. For the first ten years, it will budget $20,000/10 (i.e., $2,000 per year). After that, for the remaining life of the investment period, it will budget $20,000/20 (i.e., $1,000 per year).

One important point to note is that this tool also accounts for the “Expense Growth Rate”. This rate reflects the annual increase in the cost of replacing the item, thereby giving you a more realistic projection of your future expenses.

Growth Rates:

Rent Growth & Appreciation Rates: The annual increase in rent and property value.

Expense Growth Rate: The rate at which the cost of expenses grows annually.

Disposition:

Sale Price: The anticipated property sale price at the end of the investment period.

Closing costs at Sale: Sellers usually pay more in closing costs at sale due to broker fees. As of 2023, the average selling costs in California is 5.35%.

Itemized Closing Costs: Allows for a detailed itemization of each closing cost instead of a flat amount.

__________________________________

Output Section:

After diligently inputting all the necessary details about your investment, it’s time to examine its performance.

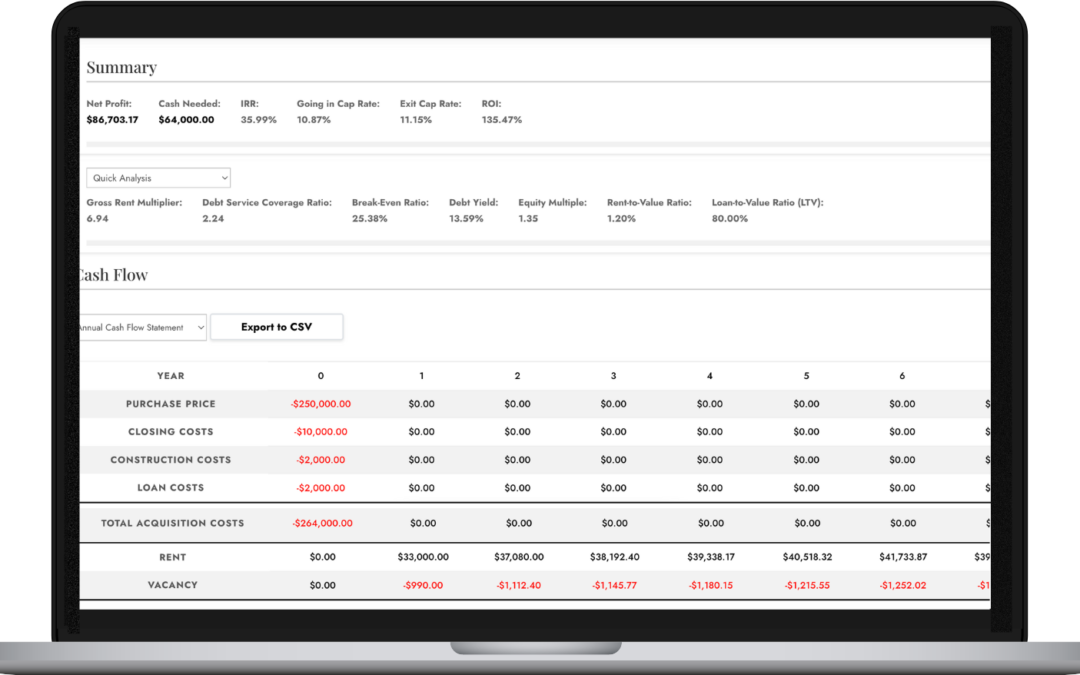

Summary:

This section provides an overview of the primary deal points, summarizing some important figures of your investment.

Net Profit: This shows the cumulative total of your net cash flow throughout the investment period.

Cash Needed: This figure indicates the total amount of money you’ll need to acquire the property. It represents the purchase price if you’re not obtaining a loan, or the down payment amount if you’re securing a loan.

IRR (Internal Rate of Return): This valuable metric indicates whether an investment is worthwhile. The IRR is the discount rate at which the net present value (NPV) of the investment’s future cash flows equals zero. Simply put, it’s the rate that causes the investment’s present value of future cash flows to equal its initial cost, or in other words, the rate that allows the investment to break even.

Going-in Cap Rate: Net Operating Income of the first year / Purchase Price. It shows the potential rate of return on the investment in its first year.

Exit Cap Rate: Net Operating Income of the last year / Sale Price. It represents the rate of return on the investment in the final year of ownership.

ROI (Return on Investment): Profit at Sale / Cash Needed. It provides a measure of the profitability of your investment at the time of sale, relative to the total amount of money you initially needed to invest.

Quick Analysis:

This segment provides additional high-level data points that are instrumental for investors when making decisions.

Gross Rent Multiplier (GRM): Purchase Price / Annual Rent in Year 1. It indicates the number of years the property would take to pay for itself in gross received rent.

Debt Service Coverage Ratio (DSCR): Annual Net Operating Income (NOI) / Annual Loan Payment in Year 1. It serves as a benchmark indicating the ability to produce enough cash to cover debt payments.

Break-Even Ratio (BER): Annual Loan Payment in Year 1 – Year 1 Annual Operating Expenses / Year 1 Annual Effective Gross Revenue. It measures the proportion of gross income used to cover operating expenses and debt service, indicating the financial stability of the property.

Debt Yield: Year 1 Annual NOI / Loan Amount. It is a measure of the risk associated with a loan by comparing the NOI to the amount of debt.

Equity Multiple: Profit at Sale / Cash Needed. It shows the total cash return on the equity invested.

Rent to Value Ratio (RTV): Year 1 Annual Rent / Purchase Price. It gives a percentage figure that represents annual rent as a proportion of the property’s value.

Loan to Value Ratio (LTV): 1 – Down Payment Percentage. It indicates the relationship between the loan amount and the property purchase price.

Financials Over Time: This section demonstrates how your investment develops over time, providing both annual and monthly breakdowns for a more comprehensive understanding.

Equity Examination:

Property Value: This component reflects the gradual increase in your property’s value due to the pre-selected appreciation rate.

Loan Balance: Your remaining loan balance, indicating the total amount you are yet to repay.

Appreciation: The monetary value of compounding appreciation over time.

Principal Paid: This denotes the cumulative amount of loan principal you’ve managed to repay over time.

Equity Accumulation: The growing worth of your equity stake in the property over the investment period.

Profitability Assessment:

This section delineates potential profits if you decide to sell the property at various junctures during the investment timeline.

Equity: Reiterates your equity holding in the property.

Selling Costs: Derived from the selling cost percentage selected in the ‘Closing Costs at Sale’ section.

Sale Proceeds: The net amount you would secure at the point of sale.

Cumulative Cash Flow: The accumulated total cash flow up to that point in time.

Total Cash Invested: The overall cash infusion made towards the investment.

Profit at Sale: A cumulative total of the other rows within the ‘Profitability Analysis’, this illustrates your resultant profit at that particular juncture.

Financials Over Time:

This section provides a dynamic portrayal of how your financial ratios progress and ideally enhance over the course of your investment period. Detailed explanations for each ratio are accessible by hovering over the associated (i) information icon.

Cash Flow:

This section shows the cash flow statement for your investment, which is a direct output of the inputs you provided. You can see either the monthly or annual cash flow statement depending on your needs. This section can also be exported as CSV for fine tuning.

Some of the rows are self-explanatory, so I’ve only outlined the ones that need explanation.

Total Acquisition Cost: Purchase price + closing costs + construction costs + loan costs

Effective Gross Revenue: Rent – Vacancy

Net Operating Income: Effective Gross Revenue – Total Operating Expenses

Net Cash Flow Before Debt: Net Operating Income – CapEx Reserves

Loan Payment: Represents the repayment amount for your loan.

Cash Out Value: This is the monetary gain at the point of refinancing or selling, subsequent to settling the outstanding loan balance.

Outstanding Loan Balance: The remaining amount yet to be repaid on the loan.

Cash Flow: This is the sum of all revenues and expenses.